| Mutual Fund |

| - Introduction |

| Investment Process |

| - Asset Allocation |

| - Security Selection |

| - Portfolio Construction |

| - Dealing |

| - Risk Management |

| Uses of Mutual Funds |

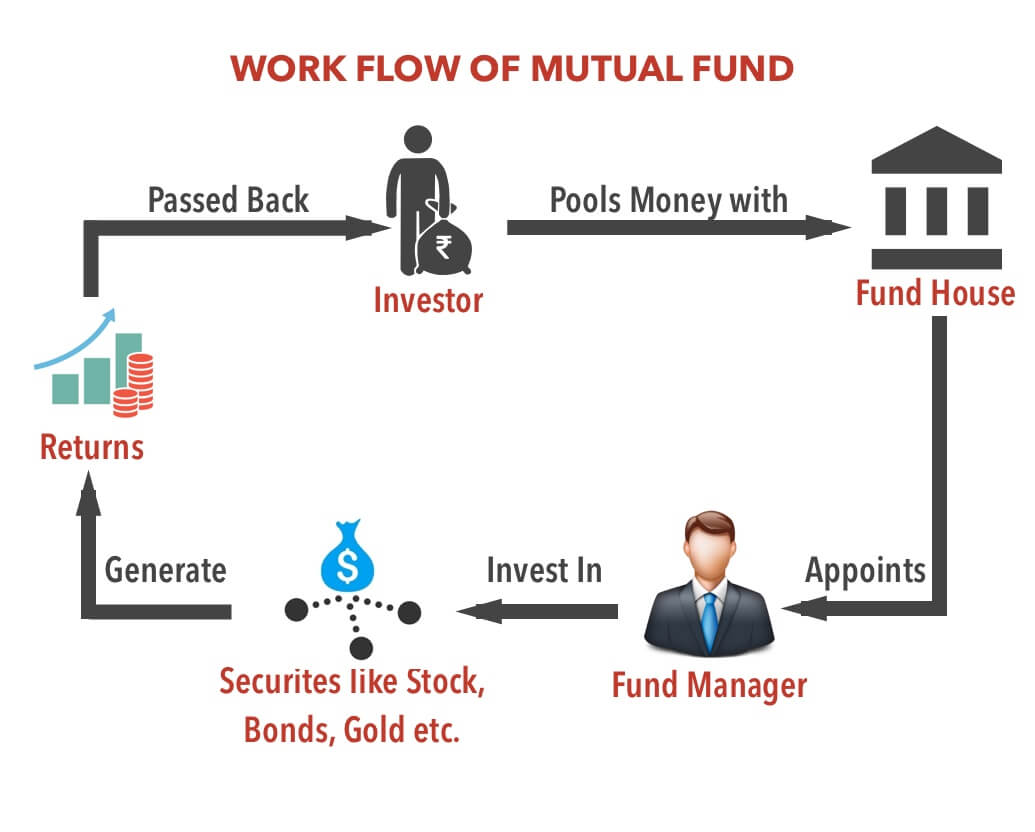

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. These investors may be retail or institutional in nature

Our core investment process is the product of our focus on change philosophy and combines asset allocation, security selection, portfolio construction, dealing and risk management. We believe high quality research drives outperformance and so we carry out rigorous research in all the major financial asset classes. We have invested steadily in state-of-art technology and have built proprietary systems to add value at every stage. While the investment process for each asset class is different, there are some core elements.

Asset Allocation

The Quadratic considers where markets are in their own cycles and determines the best allocation of assets, between equities, bonds and other types of investment. This group is made up of senior investment professionals and is responsible for providing overall strategic and tactical focus to our decision-making process. This focus finds expression in the House View, which communicates the most favoured and least favoured asset classes in the construction of client investment portfolios.

Security Selection

Our asset managers focus on selecting the best possible individual asset with the client profiles. Combined analyst and portfolio management responsibilities mean our asset managers must have the highest conviction in the assets they recommend. These recommendations can only be included in our portfolios once they have been peer reviewed and pushed through our 21 criteria quality process.

Portfolio Construction

Our asset managers select the most convincing investment ideas to construct portfolios around specific benchmarks, while also taking into account our clients risk profiles.

Dealing

Our team of experienced dealers finds the best available terms in the market, allowing our asset managers to focus entirely on research and the construction of investment portfolios.

Risk Management

Our investment process doesn't end with the purchase of assets. We continually monitor our portfolios to ensure they are meeting their objectives within the defined risk parameters. We therefore have a dedicated risk management team that measures and monitors risk. In addition, our asset managers play an active role in managing risk within clients portfolios.

Simplicity: Mutual Funds Are Easy to Understand

Anything can be made into something more complex than it needs to be and mutual funds are no exception to this truth. However, mutual funds require no experience or knowledge of economics, financial statements, or financial markets to be a successful investor. However, recognizing quality mutual funds requires expertise.

Accessibility: Mutual Funds Are Easy to Buy

Mf are easy to buy but difficult to manage. They are easy to enter but difficult to create wealth unless you know market trends have conviction and experience.

Diversification: Mutual Funds Have Broad Market Exposure

One mutual fund can invest in dozens, hundreds, or even thousands of different investment securities, making it possible to achieve diversification by investing in just one fund. However, it is smart to diversify into several different mutual funds.