Fixed Income in India has been one of the favoured asset classes and gainers almost 18-20% of all assets funds. Indians being generally conservative prefer a safer and yet return generating product to invest in. We believe in the next few years this category will grow many more products and features to help our clients to grow their wealth. At the moment we are in transition phase of a regime of "Defined by Benefit" to a regime of "Defined by Contribution". Till that happens fixed income products as they exist would continue to garner substantial contributions and get defined benefits.

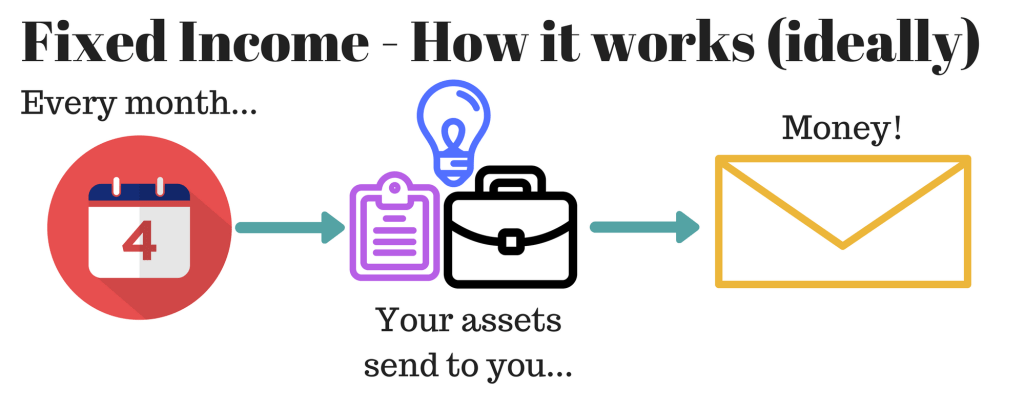

Investments in 'Fixed Income' instruments supposed to be 'Conservative' in nature and are important part of our financial assets. This class works on the principal of 'regular' income - Interest Income, within some fixed range of interest coupon rate. Hence, this asset class is ideal for various categories of investors who require regular income with minimum risk level. The preference for this asset class is by all categories of investors, especially Retired / Senior Citizens, investors with 'Conservative' Risk Profile, Charity Trust, AND for short term Working Capital Liquidity parking for business entities.

Some of the investments are of 'Aggressive' Risk Profile

The assets generally known as

Company Fixed Deposits